change in working capital formula fcff

Change in net working capital NWCt - NWCt-1. Can someon explain why.

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

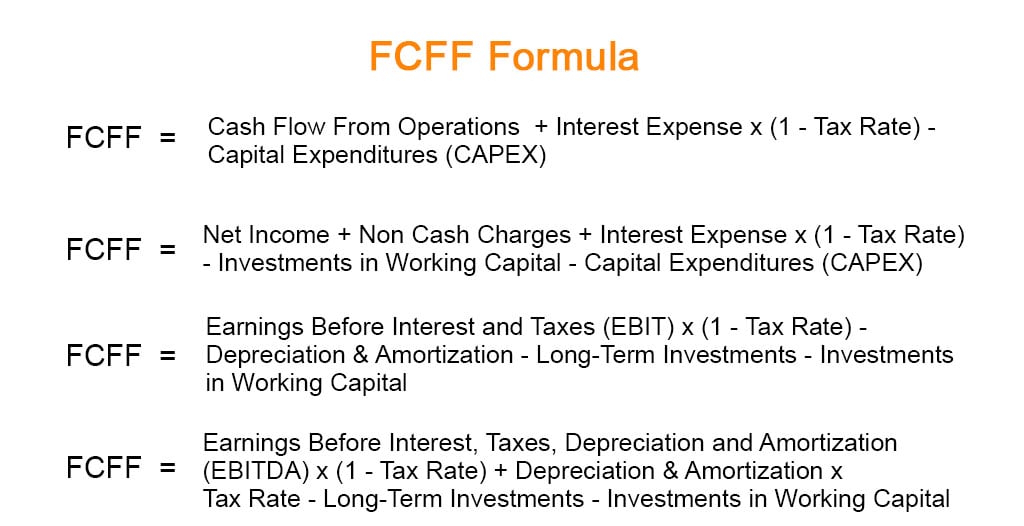

3 Alternative FCFF Formulas When a Financial Analyst Become a Certified Financial Modeling Valuation Analyst FMVA CFIs Financial Modeling and Valuation Analyst FMVA certification will help you gain the confidence you need.

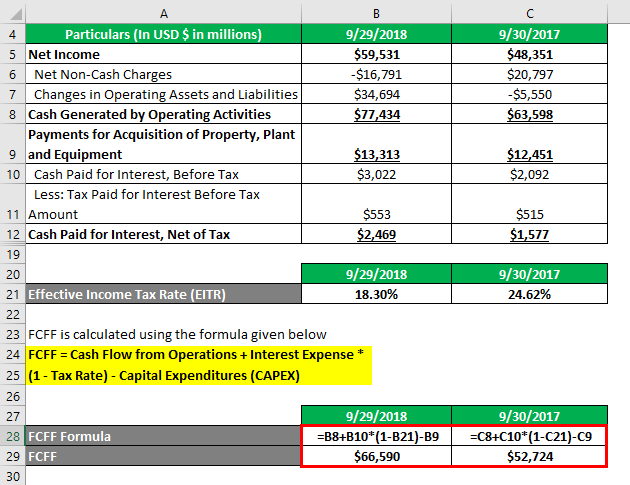

. Working capital would also increase by 20 billion. Change in a Net Working Capital Change in. It means that the cash flow available with Apple Incs suppliers of capital after all operating expenses made and meeting investments in working and fixed capital expenses.

Apple Incs FCFF has increased from 2017 to 2018. Change in Net Working Capital NWC Prior Period NWC Current Period NWC. Changes in working capital -2223.

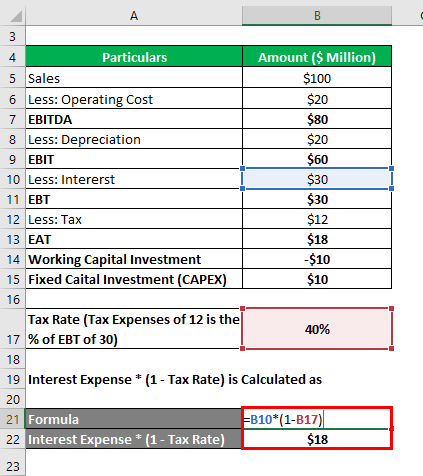

Since ongoing investments in accounts receivable inventory and fixed assets are typically essential to the continued operations of a business it is common to adjust free cash flow forecasts to reflect working capital changes. Lastly we subtract all the changes to net working capital in this case 3175 and get an FCFF value of 24856. From the 12m in NOPAT we add back the 5m in DA and then finish the calculation by subtracting the 5m in CapEx and 2m in the change in NWC for an FCFF of 10m.

So if you now have an increase in net working capital of say 10 why would you subtract this to get your free cash flow. Because the working capital requirements have increased increased inventory receivables or reduced payables and you usually look at the change as Y1 - Y2 therefore if WC for Y1 is 50 and for Y2 its 70 change in NWC is -20 therefore you are burning 20 extra cash which flows. Net working capital NWC Accounts receivables Inventory - Accounts payables Net working capital NWC Current Assets - Current Liabilities.

Working capital can be calculated in different ways based on the scenario. The amount would be added to current assets without any debt added to current liabilities. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders.

Free cash flow to the firm FCFF represents the amount of cash flow from operations available for distribution after accounting for depreciation expenses taxes working capital and investments. However at 3 growth. Change in net working capital net working capital for current period net working capital for previous period Take a look at the table above again we can calculate the Change in Net Working Capital of the firm.

In specifics the free cash flow to firm is the money left over after depreciation expenses taxes working capital and investments are accounted for a paid. FCFF is preferable to FCFE for a company with a history of leverage changes as its growth rate will be more stable than FCFE growth rate. Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period Change in Net Working Capital 6710000 2314000 Change in Net Working Capital 4396000.

Free cash flow is a measure of how much money is available to investors through the operations of the business after accounting. Owner Earnings 8903 14577 5129 13312 2223 13084. FCF EBIT 1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC If you have an increase in net working capital you have more current assets than liabilities than you did in the previous period.

Variables of the FCFF Formula. The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax rate1-t. For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it was for Amazon and Microsoft.

Change in NWC Formula. Free cash flow to the firm FCFF is the amount of cash flow left from operations for distribution after paying all other expenses. Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Or.

FCFF Net Income Depreciation Amortization Interest Expense 1 Tax Rate Capital Expenditures Net Change in Working capital Free Cash Flow Formula from Cash from Operations The cash flow from operations is the starting point for calculating FCFF CFO. Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. FCFF Net Income DA Interest Expense 1-tax rate CAPEX Change in Net Working Capital Free Cash Flow in Firm FCFF Example Assume that Company A metals industry has provided both historical data Year 0 and forecast information for three years Year 1 to Year 3 to complete a discounted cash flow DCF valuation analysis.

Free Cash Flow to Firm FCFF Formula Net Income FCFF An alternative formula to calculate FCFF begins with net income which is a post-tax and interest metric. FCFF is better for a firm with high leverage. So the change in NWC is 135000.

240000 2022 105000 2021 135000. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k. A negative change in the NWC is a burn thru of cash therefore you subtract it.

The last step is to determine the change in working capital by using the formula. As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. FCFF Formula Example 3.

Cash flow would increase by 20 billion. FCFF in terminal year EBIT6 1-t - Rev6-Rev5Working Capital as of Revenue 82061 1-036 - 13277 39242 millions Cost of Equity during stable growth phase 750 100 550 1300. Working capital is defined as current assets minus current liabilities and for this blog we are assuming that the subject company utilizes an.

What is Free Cash Flow.

Change In Working Capital Video Tutorial W Excel Download

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formulas Definition Example

Change In Net Working Capital Nwc Formula And Calculator

Change In Working Capital Video Tutorial W Excel Download

Changes In Net Working Capital All You Need To Know

Free Cash Flow Efinancemanagement

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Fcff Formula Examples Of Fcff With Excel Template

Fcff Formula Examples Of Fcff With Excel Template

Free Cash Flow Formula Calculator Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Formula Formula For Free Cash Flow Examples And Guide

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)